How Do You Protect Your 401k Before a Market Crash?

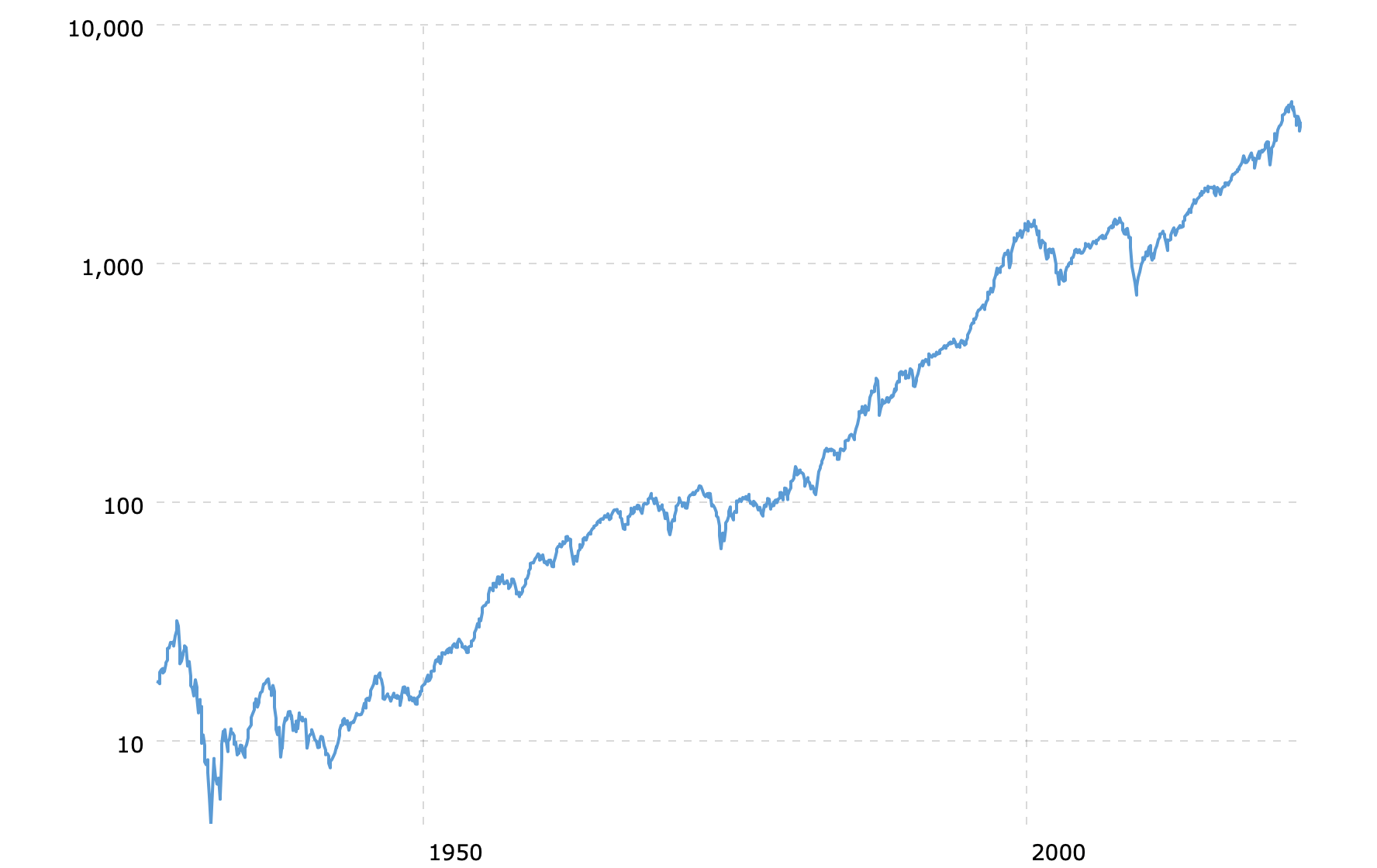

It’s true that if you buy and hold in the S&P or other comprehensive stock indexes, you’ll see an average increase of 6% per year. In fact, if you look at a graph of the S&P since its founding, you’ll see how consistent its rise really is.

But when you zoom out to look at what the stock market is doing year to year, there’s a lot more drama going on. And you’ll notice there have been some pretty severe crashes in recent decades.

When crashes such as the 2008 crash happen, is there really nothing you can do? Do you need to buy and hold with your head buried in the sand hoping and praying it will all turn out ok?

If you want to protect your 401k before a market crash, you have to be prepared in advance and you need to be able to take action quickly. What do I mean by that? I mean have the conversation now about your options for your long-term money during a crash–before we’re actually in one.

To do this, reach out to your benefits administrator and ask them how they handle major downturns and what, if any, your options are for preventing the loss of money unnecessarily. You may have some more options than you know.

That way, when a crash actually occurs, you (and your benefits administrator) will have a plan. You could think of it like having an emergency kit at home. The best time to get it all set up and stocked with rations, blankets, fresh water and a flashlight is before an earthquake occurs, not after!

No two 401k programs are alike. Each company works with a benefits administrator and chooses which funds are available as investment options. These options are usually very, very limited. Most 401k administrators have a plethora of options for during a bull market (when the market is trending up). But in a bear market (when the market is trending down), some 401ks have limited options.

Taking your account to cash means you’re getting out of the market altogether by selling all your positions at once. You’ll still keep your money in your brokerage account when you do this, you just won't have any of your money in the market for the time being, because all of your positions will be sold.

To see if your 401k program has the ability to take your account to cash, take a look to see if you have access to a “money market” or “cash” account as an option in your program.

Here at TRADEway we think like traders.

Since the market moves in cycles every few years, we imagine how different your account could look if you stepped on the sidelines during a downturn.

Some advisors may call this timing the market. I disagree. I would simply say I want to apply technical trading analysis to my investment philosophy.

If your 401k does offer a money market account, you can move your money in and out of that account while the market is volatile or in a downtrend, and still make some interest.

When should you make this switch from active positions to your money market account? Good question!

Our team at TRADEway works hard to help you make the tough decisions with technical and news analysis for the market. In our AMPT program (Assisted Managed Portfolios by TRADEway) we help preserve long-term assets by using strategies that take advantage of bull markets (when the market’s going up) and are more conservative and protective during bear markets (when the market’s going down). We want to protect your money from the crashes and major downturns.

Want to learn more about how a strategy like this could help you better preserve your long-term money?

Book a call with our AMPT team to learn more about our program.

Did you love this? Share it with your family & friends!