How to Protect Your Capital Over $250k

When your savings in any one of your accounts reaches over $250k, it becomes just as important to protect it as it is to continue to grow it. Most people know how to grow their money through investments, but most people don’t know how to protect it from a major market crash or a bank failure. If your capital is over $250k in any one of your accounts, here’s how to protect it.

Stability of the Financial System

We can’t talk about the stability of your individual investment accounts without talking about the stability of our financial system. You and I are blessed to be a part of the United States economy. Normally our economy is extremely stable.

As stable as our economy has been historically, however, it's not always stable. There are times of instability.

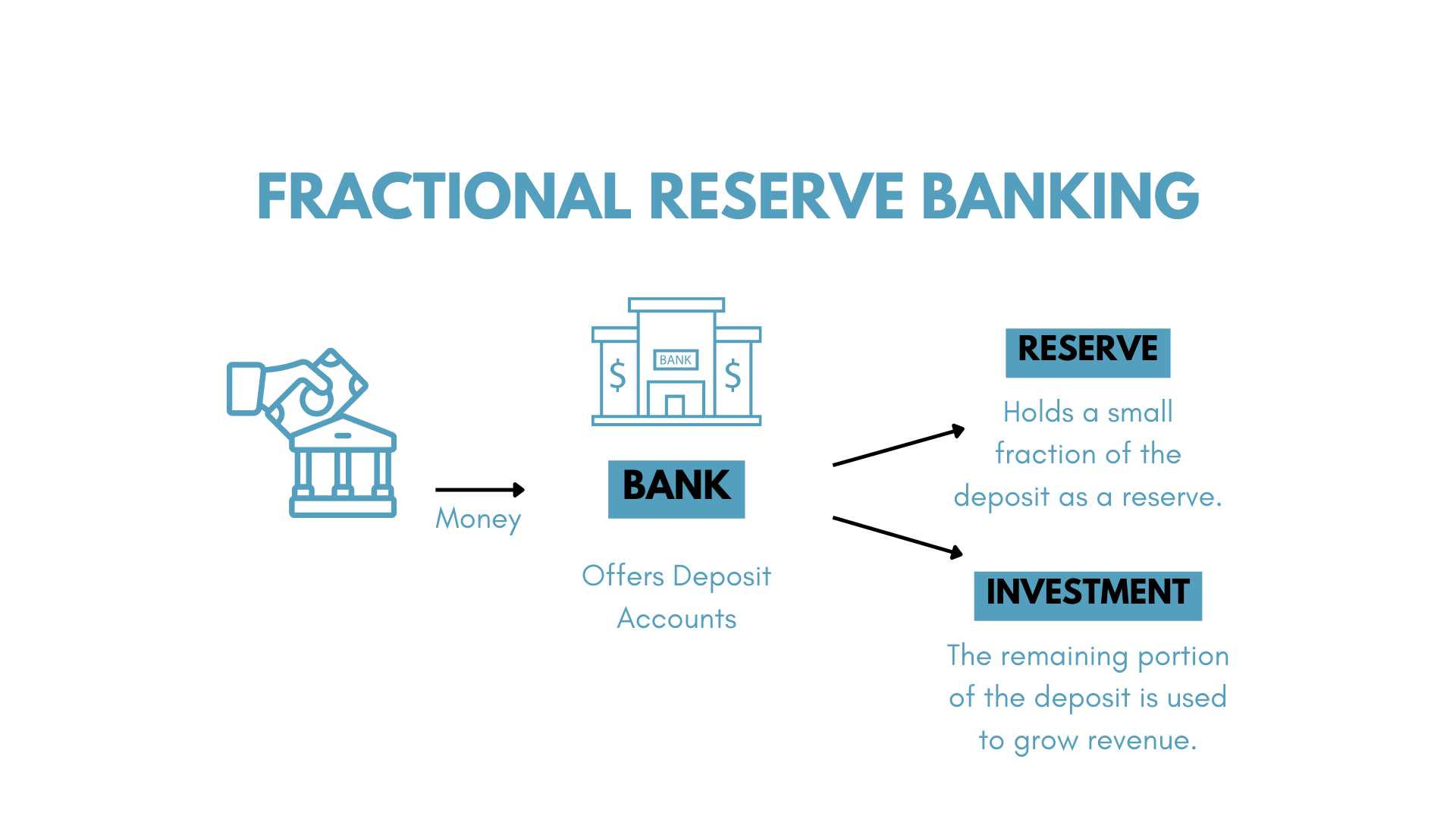

When the economy feels unpredictable, the people in charge begin to worry about our banks. Why would they worry about banks? Because when the economy becomes unpredictable, one very human reaction is to want to take your money out of the bank. This knee-jerk reaction to instability is a big potential problem because of something called fractional reserves.

When you deposit your money into your bank accounts, it doesn’t actually just sit there waiting for you to come take it out again. The bank invests some of it and also loans some of it out.

Because of this, if we were to all ask for our money back at the same time, much of that money wouldn’t be there in liquid form to take out.

This is why we have the FDIC.

Understanding FDIC Insurance

The FDIC, or the Federal Deposit Insurance Corporation, exists to help to protect your money. The FDIC helps oversee and safeguard bank deposits. It’s basically insurance on your account.

The FDIC guarantees that you can get your hands on up to $250,000 of your money. But what if you have more than that?

For example, if I deposit $500,000 into one of my accounts, am I protected up to that amount of money? Nope, only up to half. So if my account is greater than that $250,000, I probably need to start thinking a little differently.

Why? Well, because sometimes banks fail. You think it could never happen to you, but the thing is, it could. Some of these recent notable bank failures include Silicon Valley Bank, Signature Bank, and First Republic Citizens Bank. Banks do fail.

Federal Reserve Role and Impact

What is the Federal Reserve and what is its role? How did it come to be? The role of the Federal Reserve is mandated by Congress. Congress gives the federal reserve its authority.

The Federal Reserve has three mandates:

- To maximize employment

- To stabilize prices

- To moderate long-term interest rates

That's what the Congress has chartered the Fed to do. Their duty is to promote the stability of the United States economy.

The Fed is trying to avoid and prevent systemic-wide risk. And one of the threats to our economic stability that they take very seriously is runaway inflation. When prices inflate too quickly, that creates systemic problems that could become catastrophic for the economy.

The only real tool that the Fed has to keep our economy stable is control over interest rates. So their primary hammer to be able to control inflation is increasing interest rates. Unfortunately, artificially raising interest rates can cause other unintended consequences, so it’s by no means a perfect system. From history we can tell that typically the Federal Reserve has had a relatively hard time keeping the economy balanced because of the way the economy functions.

Despite fluctuating economic times, there are three powerful ways you can protect your capital over $250,000.

Here’s how we recommend you protect your capital over $250,000.

- Use brokers that offer enhanced insurance

- Split deposits across multiple banks

- Use different types of accounts

HOW Assisted Managed Portfolios by TRADEway (AMPT) CAN HELP

For our long-term investing program, AMPT, we’ve partnered with broker Interactive Brokers. One of the reasons we partner with Interactive Brokers is that they have enhanced FDIC insurance. They are part of something called the Enhanced FDIC Insured Bank Deposit Sweep Program. So joining AMPT increases your FDIC insurance to $2.5 million dollars.

Have you ever asked your financial advisor to go to cash? Most of the time when I ask this question, people don't even know they can. People don't even know that they can ask their financial advisor to go to cash.

But you are the owner of those funds. That's your money. You should be working with a financial advisor who's willing to help you to protect your assets.

How different could your portfolio look if it avoided drastic declines during major recessions? This is why the Founder and CEO of TRADEway, David Mitchell, created our long-term investing program AMPT (Assisted Managed Portfolios by TRADEway).

AMPT is built on the philosophy that avoiding periods of strong market declines could drastically affect your ability to build the kind of wealth that lasts generations. That’s what our AMPT program is built to do.

David Mitchell, our Founder, takes Biblical concepts and he uses those concepts to create the foundation of everything that we do here at TRADEway.

Another reason we have partnered with Interactive Brokers for our long-term investing program AMPT is that you earn 4.83% on cash in qualified accounts. So you are able to make 4.83% even while your money is so-called “waiting on the sidelines” for the market to get better again.

If your account is invested during an economic decline, you might see it reduced by 20%, 30%, even 40% as many people’s accounts did in 2007-2008.

Our AMPT team is here to help you avoid those major market declines by leveraging money market accounts when it makes sense to.

What Do AMPT Members Get?

- Help protecting funds with TRADEway’s Biblically based wisdom approach to investing

- We help you avoid being in the market all the way to the bottom of bear market crashes

- TRADEway offers diversified portfolios for the bullish markets and inverse positions for bearish markets

- Access to high yield money markets currently paying 4.83% at Interactive Broker for qualified accounts

- Frequent updates from our team sharing the investment decision being made

- Great support from our team

Our investing approach is different. We don’t just do a buy and hold. We think like traders. And we really do work hard to try to help you to avoid being in the market for all of those declines.

Thinking like traders, we don't want to be in for a 17 month decline (and we don’t have to be). We use technical indicators to help us to be able to know when we're in an environment in which declines are likely going to happen. We offer diversified portfolios for bullish markets. But we don’t stop there.

What's an inverse position and why do we use them? At times during a bear market, we will utilize what's called an inverse exchange traded fund. This gives you the potential to make money as the market is going down. You’re protecting a majority of your assets in cash while the market declines, and then you've got more of your capital available for the next bull market.

What kinds of accounts can you transfer into our AMPT program? We can help you with individual accounts, joint accounts, retirement accounts, traditional IRAs, rollover IRAs, SEP IRAs and even trusts.

Ready to take action? Schedule a complimentary AMPT investment consultation at tradeway.com/ampt. One of our advisors would be happy to get back with you.

Let’s Recap: How to Protect Your Capital Over $250,000

So how can you best protect your capital over $250k? You’re going to want to do the following three things. These strategies will help you protect your capital over $250,000.

- Use brokers that offer enhanced insurance

- Split deposits across multiple banks

- Use different types of accounts

We take a deep dive into these three strategies in this video:

Did you love this? Share it with your family & friends!